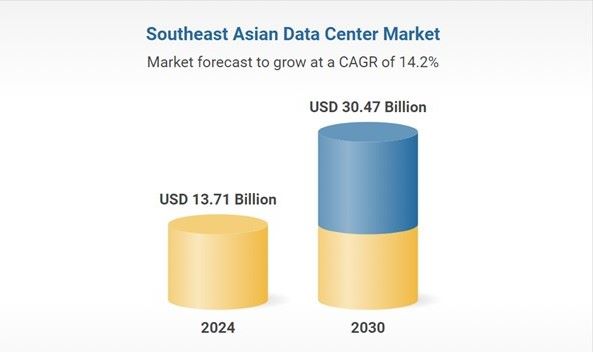

The Southeast Asia Data Center Market is projected to rise at a CAGR of 14.24% to more than double to USD 30.47 billion by 2030, from USD 13.71 billion in 2024, said ResearchAndMarket in a press release citing its latest report on Southeast Asia. The “Southeast Asia Data Center Market Landscape 2025-2030” said the Southeast Asia data center market region is poised for significant growth, driven by increased investments from colocation providers and hyperscale operators. This is due to the rise in internet users, adoption of cloud services, smartphone penetration, and the need for businesses to shift from server room setups. The major operators in the region are AWS, Meta, Google Cloud, and Microsoft.

Malaysia, Indonesia, Thailand, and Vietnam have emerged as promising investment destinations with Malaysia leading the pack over the years owing to factors like availability of cheaper land and power, among other factors. Data center investments in Singapore have slowed down in recent years due to the moratorium on data center construction. However, after the lifting of the moratorium in 2022, the market has started receiving investments.

In Indonesia, the data center investments are concentrated in major cities, due to inadequate network infrastructure and unstable power supply in rural areas. Most of the existing data center projects are concentrated in the Greater Jakarta region. There are more than 14 cloud zones operated by cloud providers like Alibaba Cloud, Amazon Web Services, Google Cloud, Huawei Cloud, Microsoft Azure, and Tencent Cloud.

Thailand is emerging as a key data center market in Southeast Asia, owing to its strategic location, robust power grid, and progressive government policies. The government actively supports this digital growth by implementing measures such as tax incentives and simplified permit processes for data centers, creating a favourable environment for the booming digital economy.

At the same time, Vietnam is also speeding up to seize opportunities from AI in terms of data center expansion.

The Southeast Asia region continues to adopt sustainable practices in data centers to adhere to regulatory requirements and contribute to environmental goals. Malaysia has favourable conditions for renewable energy generation, such as the presence of solar and hydropower, while the Thai government has unveiled its ambition to surpass a 30% increase in renewable energy supply by 2037 and achieve carbon neutrality by 2050. Meanwhile, hyperscale operators such as Google and Microsoft have signed PPAs to shift to renewable energy in the data center facilities of the region.

Some insights from the report include the following:

- The Southeast Asia data center market, particularly in terms of IT infrastructure, is primarily witnessing the use of switches with up to 40GbE ports. With the development of cloud data centers, the adoption of switches with ports varying from 25-100 GbE across multiple layers of the data center architecture will increase. Additionally, with the growing need for sophisticated infrastructure, the uptake of flash storage devices and blade servers is expected to rise in the forecast period.

- In the upcoming years, the need for generators in data centers will be high, despite generators being the major contributors to carbon emissions.

- In the Jakarta facility of IndoKeppel Data Centres, there are dedicated backup generators: 6 units of 2,000 kVA for IT, along with 2 units of 2,500 kVA and 2 units of 1,500 kVA.

- The Southeast Asia data center market is poised to see ongoing adoption of liquid cooling techniques. For instance, Digital Realty installed liquid-cooled servers in its SIN11 data center in Singapore. This reduces up to 29% of power consumption. Also, Keppel Data Centres and Salim Group’s IKDC 1 data center facility have a water-based cooling technique with N+1 redundancy.