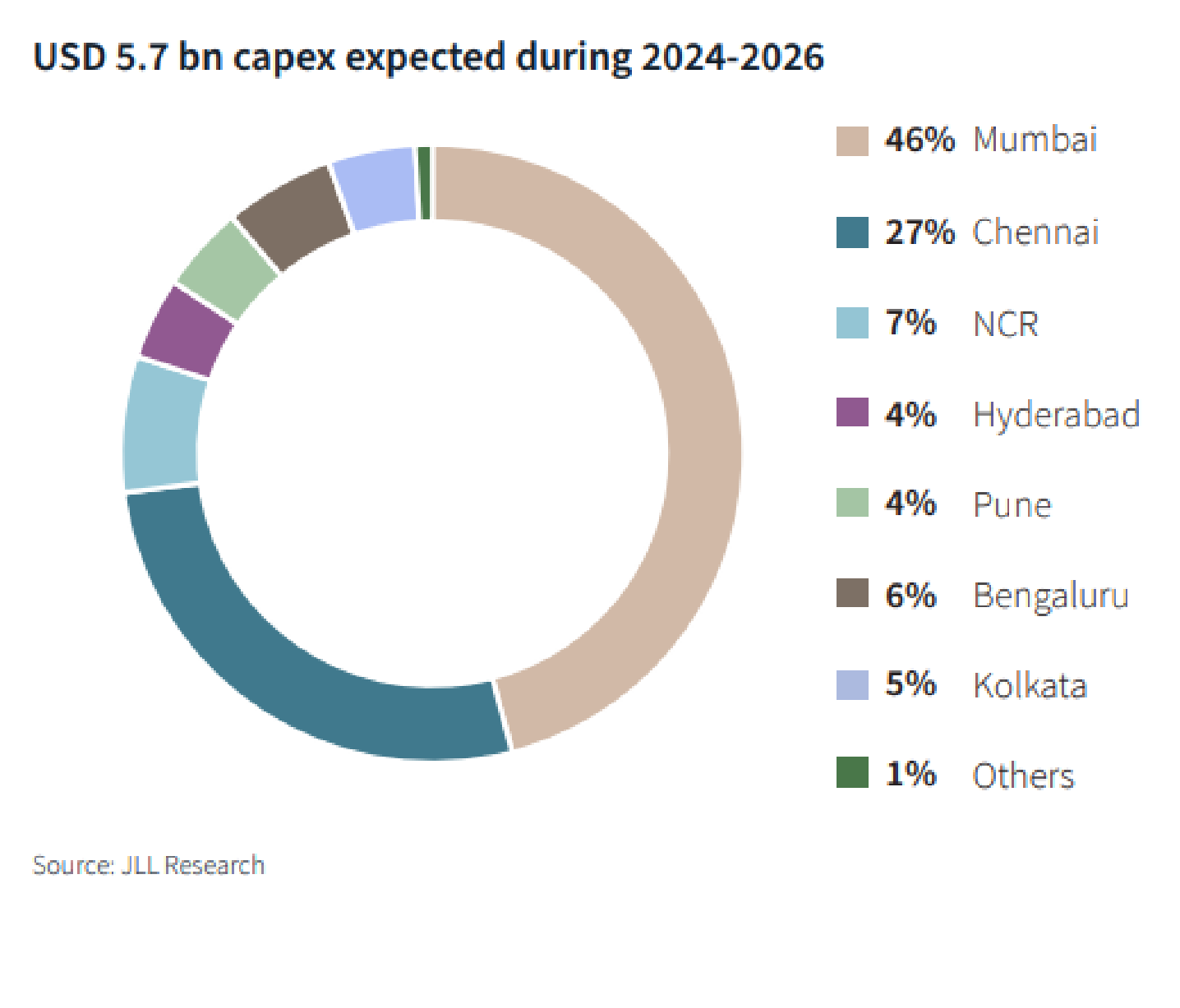

A new report released by Jones Lang LaSalle (JLL) has revealed that the Indian Data Center industry was poised to attract investments worth US$5.7 Billion by 2026 due to a surge in demand caused by the Artificial Intelligence (AI) boom and increase in 5G data consumption. The report also predicts that the industry capacity would grow to 1,645 MW by the end of 2026, with Mumbai and Chennai to account for 81 percent of the new capacity additions.

“Capital outlay of US$ 5.7 Billion would be required of which US$ 1.1bn would be towards civil construction while US$ 4.5 Billion would be towards mechanical, electric and plumbing cost,” said the report adding, “Mumbai would account for 46 percent share due to higher construction cost while will account for Chennai 27 percent and Delhi NCR at 7 percent respectively.” It further said, “Of the total real estate space requirement of 10 mn sq ft, Mumbai will require 4.41 mn sq ft while Chennai will need 2.89 mn sq ft in next three years.”

Listing reasons behind this growth, the report said, “Indian DC industry has witnessed encouraging global tie-ups along with the entry of international colocation players, which underscores its strategic importance on the global stage. Factors such as skilled resources, low construction costs, and beneficial government incentives make India an appealing global DC destination.”

The report also showcased how hyperscalers are increasingly considering India as a viable market. “Long term investment plans by hyperscale for self-build facilities highlight that India can be reliable DC hub for the world,” said the report that also found that 50 percent of user demand for data centers in India came from hyperscalers in 2023.

When it comes to Mumbai, the report found that Cloud Service Providers (CSPs) took up 60 MW of pre-committed space during H2 2023 indicating strong momentum. It further found that large-scale migration of Banking Finance Service and Insurance (BFSI) IT infrastructure to colocation is expected to dominate absorption over next few years in the market where colocation capacity stands at 454 MW.

Meanwhile in Chennai, space uptake by CSPs is expected gain pace during 2024, and AI demand is expected to gain pace as the new facilities are reported to be compatible with new infrastructure requirements.

The report also analysed markets in Delhi NCR, Bangalore, Hyderabad, Kolkata and Pune.