North Asian-focused private equity firm MBK Partners is currently deciding whether the company should join with a partner and make a bid for Vnet, a Chinese data centre company.

However, a Bloomberg report, which cited people familiar with the matter, highlighted that Vnet has also drawn interest from other investment funds in the industry beyond MBK Partners, including boutique Chinese advisory and private equity firm Hina Group and the Shanghai Branch of Industrial Bank Co..

Notably, Hina Group and the Shanghai Branch of Industrial Bank Co. had made a non-binding acquisition offer for $8 per American depositary receipt earlier in April 2022. Hence, if MBK Partners decides to go through with its bid for Vnet, the firm will have to compete with the rival offer from Hina Group and the Shanghai Branch of Industrial Bank Co..

MBK Partners, which was founded in 2005, possesses over $25.6 billion in capital which it uses for investments across Northeast Asia, including China, Japan, and South Korea. Its latest consideration to bid for Vnet indicates its continued interest in having a greater stake in Northeast Asia.

Strong Interest in China’s Largest Internet and Data Centre Service Provider

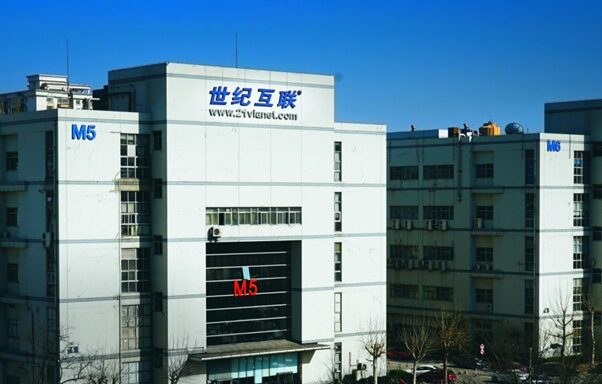

Previously known as 21Vianet Group, Vnet is the second-largest carrier- and cloud-neutral Internet data centre services provider in China, as well as the exclusive operator of Microsoft Azure and Office 365 services in China.

Vnet targets its data centre colocation services towards China’s largest cloud service providers, including hyperscale companies such as Alibaba Cloud, Huawei Cloud, Kingsoft Cloud, and JD Cloud. Since the company was first founded in 1996, Vnet now operates over 50 data centres across China, counting Blackstone and Singaporean sovereign wealth fund GIC among its current investors.

The rival bids for Vnet also align with a broader trend in Northeast Asia, where firms have a strong takeover interest in data centre companies across the region. GDS Holdings was previously evaluating an offer to combine with Chindata, a Chinese data centre company, while Hina Group had previously invested in JD.com.

Regardless, the rival offers for Vnet thus far are non-binding and both companies, MBK Partners and Hina Group, may still back out of the offer. It remains to be seen how the rival bids will be resolved.

“Outstanding Data Center Projects” is a key awards category for this year’s W.Media Asia-Pacific Cloud & Datacenter Awards. Thinking of nominating or sponsoring? Visit our Awards Page for more information. Nominations are open until 31st July.