The COVID19 pandemic has accelerated the process of Digital Transformation in different parts of the world, including Bangladesh.

But what are the areas in which Bangladesh has incorporated digitalisation?

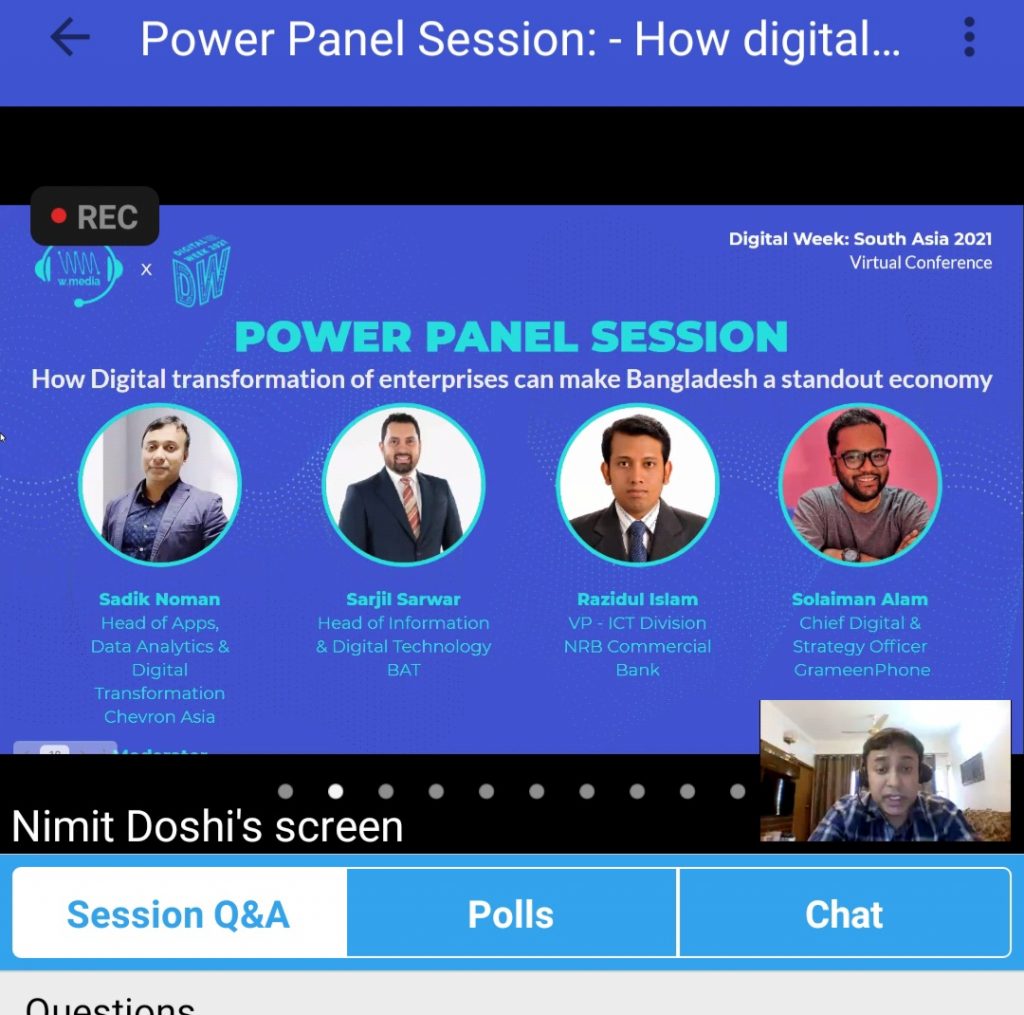

This was discussed in the panel discussion at W.Media’s Digital Week South Asia edition titled ‘How digital transformation of enterprises can make Bangladesh a standout economy in South Asia’.

The panel was moderated by Sadik Noman, Head of Applications, Data Analytics & Digital Transformation, IT Chevron Asia South Business Unit. The panellists included Sarzil Sarwar, Head of Information and Digital Technology, BAT; Razidul Islam, Vice President, ICT Division, NRB Commercial Bank and Solaiman Alam, Chief Digital and Strategy Officer, Grameenphone.

E – Learning, tele medication, online education and entertainment has seen a significant rise in the demand. E- Commerce platforms have been in demand during the pandemic due to limited people movement.

The e-commerce sector is expected to boom in the coming days and the digital payment will take over the cash payment, underlined Sadik Noman.

COVID-19

“We all know what role COVID has played in our daily life, with respect to digital adoption. I have not been to my office from a very long time. There has been a massive uptake in streaming and other subscription services throughout the country. Now the question is how do we leverage on the data that has been generated by users”, said Sarzil Sarwar

He further added that now it is important to focus on what are the things that we can hold on to in terms of behavior and not go back to the ways of working that we were doing before COVID19 and also leverage on the capabilities that one has developed over the year with e- learning, work from home and others.

It is also important to leverage on the analytics that has been gathered from the population and the digital footprint. These are some of the factors that has accelerated the process of digital transformation.

“The technology was always there, it is just a matter of adoption. The pandemic had turned out to be the mother of all necessities. Many organisations decided to take up collaborations to in order to adapt different office and technology tools along with the adaptation of cloud as that was one of the ways in which they could continue working”, said Solaiman Alam.

He further added that the digitalization that has accelerated due to the pandemic has also had a big impact on the government as well.

Meetings were made possible on virtual platforms and there wasn’t a requirement of going and filing things physically it could be done online. The government agencies have also adopted digitalisation to a certain extent.

Giving an example of shopping malls he explained that their business is still more or less dependent upon the physical footfall and there is still a long way to go in the journey of digitaisation.

The future of Fintech in Bangladesh

“Banks are coming up with technical solutions with the help of which banking services are also accessible in rural areas”, said Razidul Islam

With the help of sub branches, the people of remote areas are connected to the bank and are able to access the services. People can avail all the services from the sub branches.

He further added that banks are coming up with mobile banking application services for their customers which will enable people to avail all the banking services on their phone without physically being present in the bank.

Banks are also introducing a facility called a digital onboarding wherein it would be possible for people opening an account online.

Internet banking is getting popular and making the life of people easier, especially in times like these during a pandemic when the movement of people is restricted.

“The smartphone penetration currently, is over 40 percent and 4G handset penetration is more than 25 percent and is constantly increasing”, said Alam.

He added that there are certain financial inclusions progressing towards the processes of digital transformation.

Customers want services which are low cost and fast, adopting a technology a bit late has an added advantage to it, which include adopting a better technology or moving away from legacy and directly adopting a better technology.

“Companies don’t necessary need to invest in a huge infrastructure, build ATMs. The same services could be given using technologies. It is faster and cost effective”, added Alam.

He further added that technologies are already existing we just need to adapt to it.

The reason why a lot of the new technologies are being adopted are because of mainly three things.

“First is the viability of the smart phones, the connectivity because of the high speed internet. It is not at the perfect speed but you are still able to run your business, work from home, do transactions”, said Sarzil.

The digital transformation strategy has to be in line with the broader business strategy.

According to a report in Medici, The current startup ecosystem in Bangladesh is valued at $1.45 billion and has the potential to reach a $10 billion. Financial inclusion in the country increased from 16% in 2011 to 37% in 2018.

Despite remarkable progress, Bangladesh remains one of the economies with the largest unbanked population. All FinTechs put together process $4 billion in monthly transactions.

The Remittances segment is catching up owing to money transfers by expatriates. Lending and Personal Finance are the other segments that are registering growth.