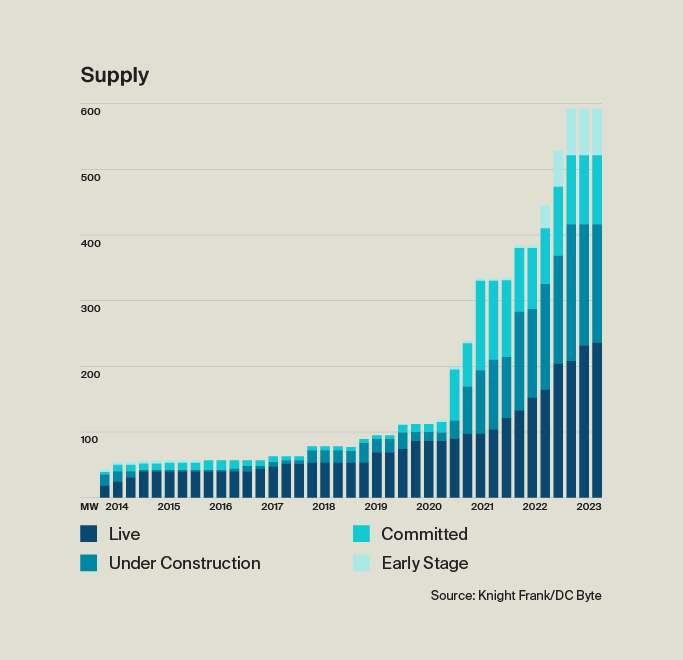

The United Arab Emirates (UAE) has emerged at the largest data center hub according to a report by Knight Frank, a leading independent global property consultancy. According to the report titled Data Centers – The MENA Report, in 2023, the UAE recorded a 15.3% increase in live IT capacity, reaching 235.3 MW.

It finds that this increase is part of a broader expansion, with a 64MW rise in aggregate supply, or a 12.1% growth. The report says that, at present, the UAE boasts a total IT capacity of 592MW, including 180.3MW, that is actively under construction. This is not surprising, given how the UAE has been working steadily to achieve its digital transformation goals for over 20 years.

The report says, “The creation of the Dubai Internet City (DIC) in October 2000 played a pivotal role in attracting innovative technology companies to the country. This influx served to emphasize the vital role of data centers in future business growth, and so data center investment and development started to meet rising demand.” Further tracing the journey of UAE’s emergence as a data center hub, it says, “Subsequent government initiatives, including tax incentives and regulatory frameworks, further encouraged the industry’s growth. During the 2010s, international data center providers started entering the market, enhancing the quality and global connectivity of data center services. Ambitions, of both Dubai and Abu Dhabi, to become global technology and business hubs have meant additional government support more recently. This, coupled with a focus on sustainability and innovation, is solidifying the UAE’s position as a major data center market.”

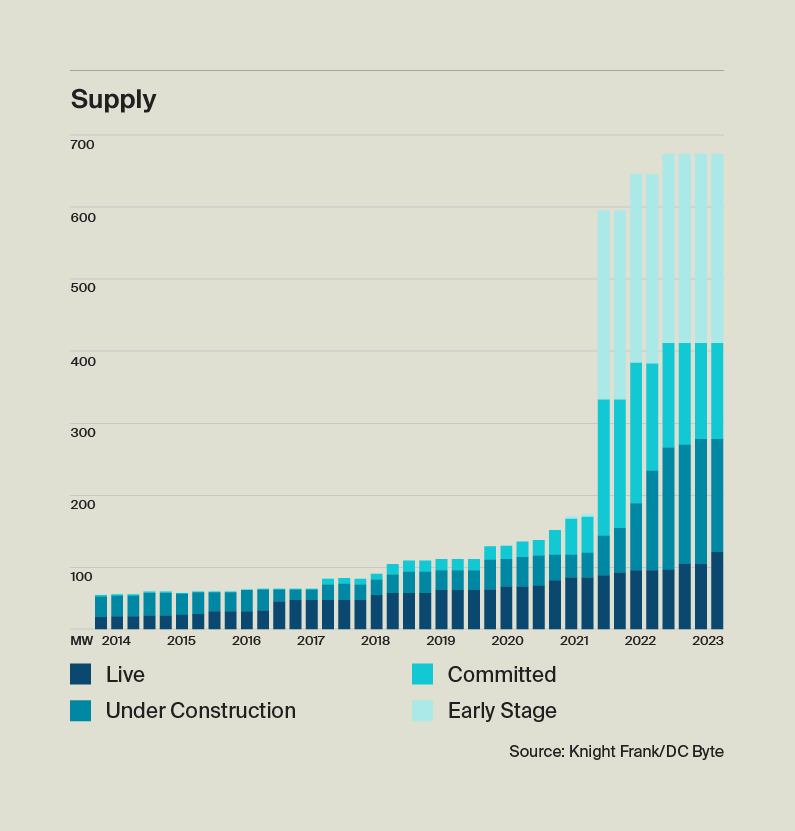

But it isn’t just the UAE. Today, the Kingdom of Saudi Arabia (KSA) is also emerging as the fastest growing data center market. The report finds that this is due to “the strategic location of Saudi Arabia, political stability, and growing domestic and international demand for digital services” as well as KSA’s ambitious Vision 2030.

The report finds that “Saudi Arabia is the fastest-growing data center market in the Middle East, with live IT capacity having risen by 29.7% to 109MW since the turn of the year. The data center market is split between three main hubs – Riyadh, Jeddah, and Dammam – which host 80% of live IT supply, or 40MW, 29MW and 19MW each, respectively.”

According to Stephen Beard, Co-Head of Global Data Centers, Knight Frank, “Across the Middle East, over a quarter of the population is between 15 and 29 years of age. This section of the population is important to future data centre growth as it comfortably embraces technology for a broad spectrum of educational, professional, and social needs. Therefore, the demands placed on data center services will only increase, making it a prime opportunity for Knight Frank to contribute to this exciting growth.”

He further says, “Markets like Bahrain, Jordan, Kuwait, Lebanon, Oman, and Qatar are experiencing data centre growth, anticipating a need for 500MW and an investment of approximately c.$5 billion over the next 7-9 years.”

In North Africa, Egypt is fast emerging as a market to be reckoned with. The report finds, “As of Q3 2023, aggregate supply in Egypt had reached 154.7MW, reflecting an increase of 133MW over 12 months. In 2023, major announcements have come from UAE-based Khazna Data Centers that announced development plans for a US$250 million state-of-the-art facility in Cairo. This coincided with Gulf Data Hub and Elsewedy Data Centers committing to invest a combined US$2.1 billion across three locations in Egypt as part of a joint venture. GPX Global has also announced a 12MW expansionary plan for its Cairo 2 facility.”

Another African market to keep an eye on is Morocco. The report finds that “Aggregate supply in Morocco is now at 65MW, reflecting a 48MW increase in 2023. This rise is the result of a three-facility announcement from Gulf Data Hub, which aims to bring the first wave of wholesale colocation capacity to the country, with the first go-live dates targeted for 2026.”

According to the report, “The principal data center market in Morocco is Casablanca, which hosts 69% of the country’s live IT capacity, as well as 96% of the current pipeline developments. In Q3 2023, the African Infrastructure Investments Managers (AIIM) announced plans to invest US$90 million into Morocco’s N+ONE Datacenters facilities through its latest infrastructure fund, African Infrastructure Investment Fund 4 (AIIF4). This would involve investment into a new Pan-African data center and cloud services platform, with a short-term capacity target of 40MW. The partnership will see N+ONE expand its existing campuses in Morocco and Senegal while developing new hyperscale locations.”