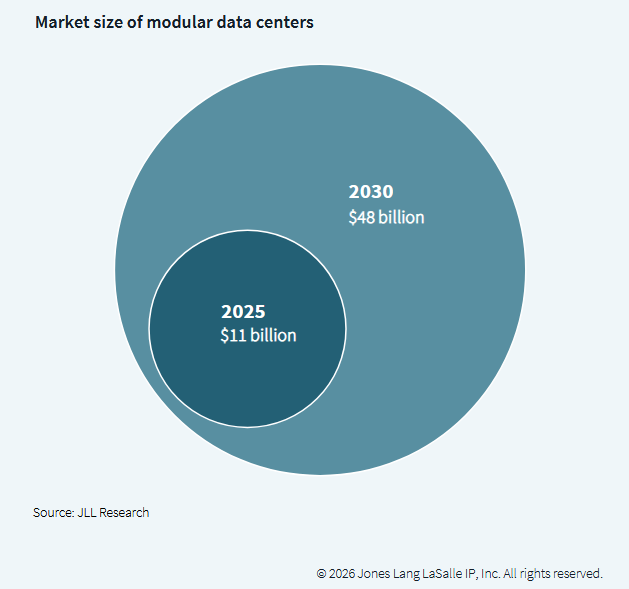

Annual sales of modular systems and micro data centers could reach a whopping US$ 48 billion by 2030, finds a recent report by real estate consulting and research firm JLL. It further finds that there will be a shift in the industry from “build-to-suit” development to “assemble-at-scale”. This represents a 35 percent revenue CAGR over five years.

The report titled 2026 Global Data Center Outlook, highlights a structural shift toward modular and prefabricated development. “Modular systems have several advantages over on-site construction, including faster install schedules and reduced costs due to construction efficiencies,” says the report, adding, “Modular designs could evolve beyond containerized units to sophisticated scalable mega-modules of 10 MW or more. Modular technology will also support geographic expansion. By 2028, more than 15,000 micro data centers may be operational worldwide, with significant deployments in Africa and Southeast Asia.”

JLL also predicts that the modular industry could undergo “significant consolidation over the next few years with five major players remaining” and that new regional assembly hubs could reduce logistics costs by 40 percent, enabling eight-week delivery cycles.

The broader picture

Overall, JLL finds that nearly 100 GW of new data centers will be added between 2026 and 2030, likely expanding at 14 percent CAGR. Hyperscalers will remain the primary growth driver, fueled by cloud and AI workloads and balancing self-built facilities with third-party leasing.

The Americas lead with 50 percent of global capacity, growing at a projected 17 percent CAGR, while APAC is expected to grow from 32 GW to 57 GW by 2030 at 12 percent CAGR, as cloud migration and colocation adoption accelerate. Meanwhile, EMEA’s 10 PERCENT CAGR forecast is fueled by government support for AI infrastructure, and strong demand for sovereign AI clouds to meet data privacy regulations. “The region will add 13 GW of new supply, with growth concentrated in established European hubs and emerging Middle Eastern markets pursuing digital transformation strategies,” finds JLL.

Colocation is a major growth pillar as enterprise on-premises footprints reduce. JLL estimates US$ 1.2 trillion in new real estate value for the sector between 2026 and 2030, supported by US$ 870 billion in new debt financing, alongside US$ 1–2 trillion in tenant investment, GPUs and networking. Enterprises are increasingly adopting hybrid strategies combining on-prem, colocation, and cloud, with sensitive workloads in finance remaining on-site.

Supply chain challenges and DC delivery delays

When it comes to building, delivering and deploying data centers, JLL finds that while global data center equipment lead times have stabilized year-on-year, and equipment manufacturers have been adding production capacity, keeping pace with the rapid expansion of the sector has proved challenging.

“The average build time globally for a 50 MW data center is 18 months. Developers are preordering select materials as much as 24 months in advance to avoid project delays,” finds the report, and reveals, “Despite this, 57 percent of data center projects experienced a construction delay of three months or more in 2025.”

JLL’s base case assumes a 14 percent global supply CAGR, with upside and downside scenarios of 20 percent and 7 percent, respectively. This forecast is derived from a bottom-up assessment of regional markets and property subtypes, incorporating supply pipeline visibility and the expectation that innovation will partially alleviate energy constraints. Under this scenario, new supply is largely absorbed, keeping global vacancy below 10 percent.

The 20 percent upside scenario reflects AI-driven supply acceleration beyond the base case, supported by rapid adoption of advanced technologies. However, sustaining this pace becomes increasingly difficult at scale and introduces elevated oversupply risk.

The 7 percent downside scenario reflects potential supply headwinds, including capital pullbacks, prolonged energy and supply chain constraints, macroeconomic weakness, and geopolitical limits on technology trade.

Leasing, occupancy and vacancy

Leasing conditions are restricted. The leased segment will add 62 GW through 2030, global occupancy stands at 97 percent, and 77 percent of the construction pipeline is pre-committed. Lease rates are forecast to grow 5 percent CAGR globally through 2030, led by the Americas at 7 percent. Hyperscalers are expected to spend about US$ 1 trillion on data centers from 2024 to 2026, adding 41 GW of owner-occupied capacity.

These findings are in line with what findings of other major real estate and digital infrastructure consulting and research firms. We have previously reported on skyrocketing occupancy rates based on the findings of DC Byte, a market intelligence platform, and Knight Frank, a global real estate consultancy, each of which revealed that data center demand has reached historic levels globally amid dwindling supply attributed largely to power supply constraints. Global take-up rate had increased by 30 percent on 2023 figures for a total of 12,975 MW across both colocation and self-build schemes, said the 2025 edition of the Global Data Centre Index report. The three-part report was based on 7,500 data centers tracked globally from 2019 to 2024 by DC Byte’s analysts.

The Knight Frank report titled Data Centers: The EMEA Report also finds Frankfurt, London, Amsterdam, Paris and Dublin markets (FLAP-D) remain the central hubs for capacity expansion driven by deployment from the major global cloud hyperscalers. However, all these cities have extremely low vacancy, and that coupled with grid constraints thus digital infrastructure here is struggling with the burgeoning demand.

Future considerations for corporate and investors

Given power constraints, JLL advises corporates to prioritize reliable power over location or cost, with early utility engagement and on-site generation critical amid multiyear grid delays. High global occupancy at 97 percent, gives landlords leverage, pushing rents higher through 2030. AI is driving denser racks and liquid cooling, while hybrid portfolios—on-prem, colocation, hyperscale, and edge—become standard. Construction and supply chain delays make flexible, modular designs essential, as corporates secure long-term capacity and balance cost with flexibility.

The sector is entering a capital-intensive super cycle, with combined real estate and tenant CapEx projected at US$3 trillion by 2030. Rising entry barriers concentrate power access, financing, and execution among fewer players. Development risk is growing for sites without secured power, while liquidity is diversifying through Asset-Backed Securities (ABS), Commercial Mortgage-Backed Securities (CMBS), and bank debt. Regulatory and community factors increasingly influence valuations and timelines, favoring AI-ready, liquid-cooled assets. Structured finance strategies, renewable and water-efficiency alignment, early partial liquidity events, and proactive community engagement help mitigate risk, preserve equity, and support long-term project success.

Conclusion

Execution risks remain high, in 2025 over half of data center projects faced construction delays, 57 percent delayed by three months or more, and equipment lead times remained above pre-2020 levels. JLL concludes that the sector is at the start of one of the largest modern infrastructure investment super cycles, with outcomes dependent on power availability, supply chain stability, and AI-driven demand.

Investors and developers must balance speed to market with capital efficiency amid supply chain constraints, energy availability, and shifting demand signals. Competitive advantage will accrue to those that can scale supply flexibly as AI models and use cases evolve.