As per a recent JLL report, AI workloads would account for half of all workloads by 2030, with inference alone accounting for over a third of the workloads. In this piece we take a deeper look at how AI will reshape global digital infrastructure over the next five years.

The JLL report titled 2026 Global Data Center Outlook found that AI represented about a quarter of all data center workloads in 2025, with training driving most of the demand. However, it anticipates a “significant shift” in 2027, when inference workloads could overtake training as the dominant AI requirement.

The three transformative waves

The report finds that the AI inference evolution will unfold in three transformative waves from 2025 to 2035. In the first wave – Cloud Centralization – the majority of inference workloads will be handled within existing cloud regions by the largest hyperscale companies with centralized infrastructure, due to cost and performance advantages. These facilities will begin to feature purpose-built inference clusters using custom-made chips. It also finds, “The geographic concentration will initially be stark: 80% of global AI inference will occur in fewer than 50 clusters, primarily located in core markets and major population centers.”

The second wave – Hybrid Transition – will see the rise of “inference at the speed of business”, where AI responsiveness becomes more critical than raw capability. This begins around 2027. “Data center companies will leverage existing fiber infrastructure to create regional inference hubs, while industry-specific clusters will emerge such as healthcare systems for real-time diagnostics, low-latency financial services for trading and fraud detection, and on-prem manufacturing systems for predictive maintenance,” finds JLL.

The third wave – Edge Intelligence Evolution – will be defined by “invisible AI” as inference capabilities are seamlessly embedded into devices, with smartphones potentially handling complex reasoning tasks that previously required cloud resources. This wave will begin around 2032. “Network effects will become crucial as edge AI value increases exponentially through device collaboration, putting smart cities with AI capabilities and existing infrastructure at a significant advantage compared to those with isolated applications,” says the report.

Rise of Neocloud

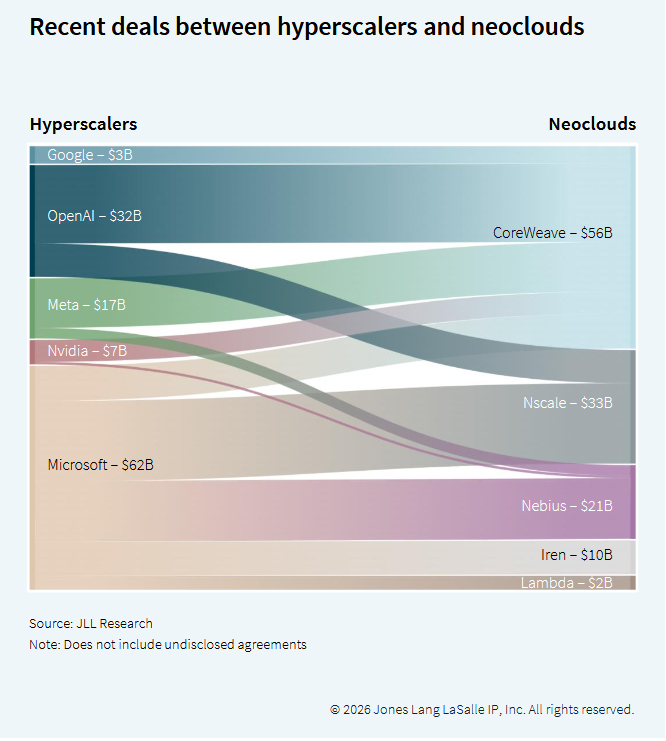

Neoclouds are specialized cloud companies offering GPUs as a service. JLL says that AI infrastructure demand will explode over the next five years, driven by the 2027 intersection where inference workloads overtake training. “This shift to distributed edge deployments plays directly to the core strengths of neocloud providers: flexibility, rapid deployment and geographic diversification.” The report also finds that the relationship between hyperscalers and neocloud providers is evolving from competition to partnership. “While hyperscalers dominate cloud services through scale, they’re increasingly partnering with neocloud providers for AI

workloads that require larger capacity requirements, broader geographic reach and faster deployment times,” it says.

Growth of sovereign AI infrastructure

According to JLL, the sovereign AI infrastructure market represents a US$ 8 billion CapEx opportunity by 2030, driven by regulatory mandates requiring local or domestic data processing. “Unlike traditional infrastructure, data sovereignty requirements limit competition to only local providers, enabling up to 60 percent pricing premiums over standard market rates.”

We have already seen several examples of countries investing in developing their domestic AI capabilities, such as HUMAIN in the Kingdom of Saudi Arabia, or India’s National AI Mission. “Through data sovereignty regulations, countries are addressing defensive needs (protecting sensitive data from cross-border risks) and offensive goals (building independent AI capabilities). The shift toward localization and security is creating demand for AI facilities across the globe,” finds JLL.

Spending on AI chips to rise

Given how there will be a huge surge in AI infrastructure demand, JLL says that data center semiconductors would also undergo a “dramatic transformation” by 2030, as “ AI chips are projected to grow their total revenue share from 20 percent to 50 percent.” JLL says that this will be “one of the most significant shifts in computing history.”

JLL anticipates that this shift will create a US$ 180 billion data center semiconductor sales market, with AI GPUs priced between $15,000 and $30,000 compared to $1,200 for traditional CPUs. “Infrastructure implications include the tripling of average rack density to 45 kW with 80 percent liquid cooling adoption for new facilities,” says the report, adding, “Custom silicon chips will capture an estimated 15 percent market share, with the hyperscalers developing their own processors.”