The energy was palpable at the Grand Nexus Ballroom in the Connexion Conference & Event Centre, where over 1,800 industry leaders gathered for the Malaysia Cloud & Datacenter Convention 2025. To start the day’s discussion, Paul Mah, Executive Editor at W.Media, posed a central question that hung in the air: Can Malaysia’s data center market, currently in a ‘once-in-a-generational’ boom, sustain its incredible momentum without eroding the very fundamentals that made it happen?

The discussion, titled “From Overflow to Epicenter: Navigating Malaysia’s Data Center Investment Surge,” brought together key voices from finance, government, and infrastructure to dissect the nation’s meteoric rise. The consensus was clear: the boom is no accident, but the next phase of growth will be markedly different.

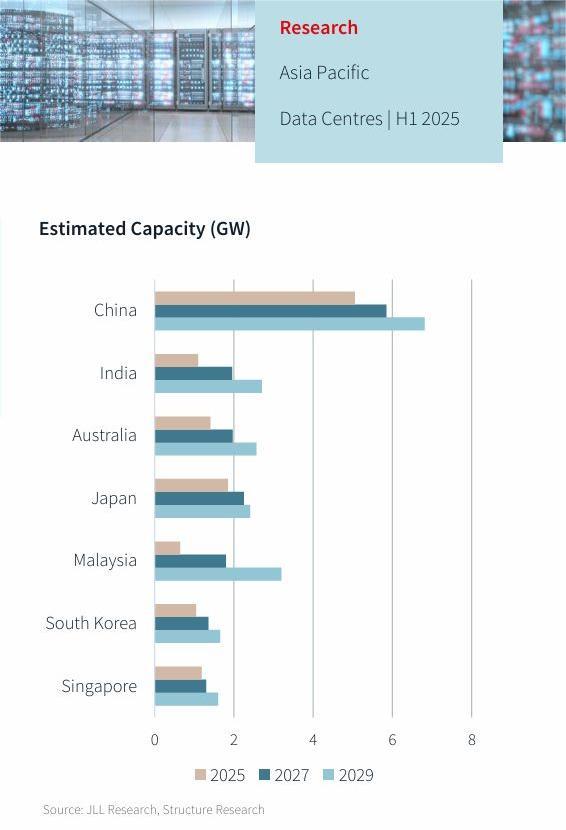

The chart that tells a story

The conversation kicked off with a compelling visual, a chart from JLL’s APAC Data Center Market Dynamics report. It showed Malaysia trailing in regional capacity for 2025, only to surge ahead of established players like Singapore and South Korea by 2027 and lead by 2029 .

“You don’t build data centers overnight,” Paul Mah noted, highlighting that the growth visible today is the result of phenomenal groundwork laid over the past two to three years. This set the stage for a deep dive into the forces behind the surge and the challenges on the horizon.

How Malaysia became an epicenter

The panelists identified a confluence of factors that propelled Malaysia onto the global stage.

Wan Murdani Wan Mohamad from MDEC pushed back against the narrative that Malaysia is merely a “spillover effect” of Singapore’s moratorium. He emphasized that a deliberate government decision a decade ago to prioritize and attract “catalytic investors” was crucial. “It wasn’t an easy task… because there was no validation,” he said, noting that bringing in the top hyperscalers first created the critical mass and validation for others to follow.

Meanwhile, from the investor’s lens, Joe Liew from CLSA provided the financial perspective, highlighting how the data center theme has electrified the Malaysian stock market. He reported construction company order books doubling or tripling, property firms profiting from land sales, and utility companies seeing increased demand. This theme, intertwined with the global AI boom represented by giants like Nvidia and TSMC, has attracted significant foreign and domestic investment, causing related stocks to rally over 30% in the past year.

Mahathir Bin Said of TM Nxera recalled TM’s early gamble a decade ago to build mega data centers, a move that was ahead of its time but ultimately helped pave the way. “Twenty megawatt those days was considered huge… nowadays we are not considered large anymore,” he stated, underscoring the scale of current developments, such as his own company’s plan for a 200MW campus in Johor.

The rising tide of challenges

The discussion then turned to the headwinds that threaten to cool the overheated market. Joe Liew pointed to a stark new reality: the equation for building in Malaysia is becoming “a lot more difficult.”

Soaring Costs: Land prices in key areas like Johor have doubled or tripled. Electricity prices saw a 15% hike this year, and resources like water for cooling are becoming scarcer .

Evolving Incentives: Wan Murdani explained that the government’s incentive structure is maturing. The front-loaded, zero-tax incentives are giving way to an outcome-based model where tax breaks are tied to delivered economic impact. “Everybody has to compete on a level playing field when the particular industry has reached a certain maturity,” he stated.

Regional Competition: The panel acknowledged that Malaysia is no longer alone. Neighbors like Thailand and Indonesia are actively rolling out the red carpet, forcing Malaysia to compete on more than just cost.

Sustaining the momentum

Faced with these challenges, the panel outlined a multi-faceted strategy to secure Malaysia’s future.

Joe Liew pointed to the government’s commitment as a key consumer, citing the 2 billion ringgit allocation for a sovereign AI cloud in the 2026 budget. This, coupled with data sovereignty concerns from sectors like banking and government, ensures a strong local market. “Don’t forget local consumption,” he urged.

Mahathir stressed the need for a “win-win” situation where businesses contribute to talent development and the local supply chain. He highlighted work with universities to tailor curricula in engineering and business to support the industry’s multi-disciplinary needs.

Wan Murdani underscored Malaysia’s “whole-of-government approach,” involving agencies like MITI, MIDA, MDEC, and the Ministry of Digital. This cohesive strategy, combined with a focus on digitalizing high-growth sectors like public services and finance, aims to create a pervasive and ubiquitous market for digital services. The goal is to make Malaysia the preferred landing point for investors looking at the ASEAN region, projected to be a US$1 trillion digital economy by 2030.

A journey just begun

As the session concluded, the panelists shared their vision for the next three to five years. They saw Malaysia evolving from a pure infrastructure play into an integrated digital hub.

Wan Murdani kept the end-game in sight: the US$1 trillion ASEAN digital economy. Joe Liew remained positive about long-term growth, albeit at a more sustainable pace than the initial explosive surge. Mahathir envisioned a future where the data center boom spurs advanced capabilities in AI, machine learning, and software development.

Paul Mah perfectly captured the sentiment: “It looks like we are… at the start of a brave new world, a fantastic new journey.” The message from the convention was clear, Malaysia’s data center story is far from over. It is simply entering a new, more complex, and more promising chapter.