Demand will surge …

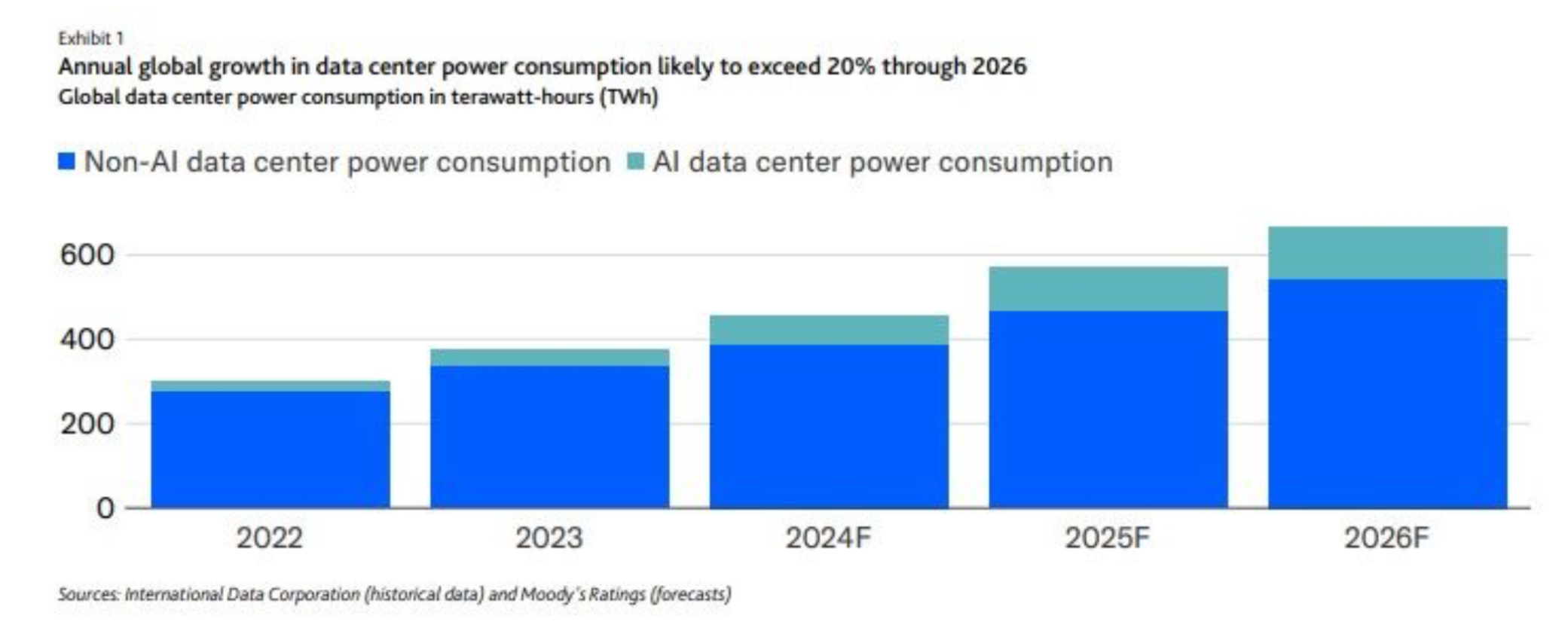

Ratings agency Moody’s forecasts global data centre capacity to surge again in 2025. In Asia-Pacific, the combination of government incentives, US-China tensions and new restrictions on cross-border data transfers will support growth in emerging data centre markets, states Moody’s in its latest Outlook report [1].

As a result, developers will incur more debt to build and upgrade data centres as demand exceeds supply although in some markets, data centre projects may face resistance or regulatory hurdles.

Most of the new capacity coming online is pre-leased to Microsoft, Google, AWS, Meta and Oracle, which will limit the risk of introducing a significant surplus of unoccupied capacity into the market. Additionally, new colocation data centre capacity is being developed for small to medium-size tenants who pay higher lease rates on a per kilowatt per month basis. Moody’s reckons vacancy rates may briefly uptick in some markets until this newly available colocation capacity is fully leased. But they will remain low given supply constraints in most markets.

This growth requires data centre developers and landlords to raise substantial development capital in the form of equity, bank loans, corporate and securitised bonds, or project finance vehicles. Leverage levels will likely increase for developers focused on hyperscale buildouts to be completed in 2026-28. As a result, leverage levels will likely increase over the next 12 to 18 months and remain elevated as developers engage in an accelerated construction cycle. The revenue necessary to service this new debt will become available once these facilities are operational and accessible to tenants, often through pre–lease arrangements.

Medium-size and large data centre REITs and developers have been eagerly snapped up by major private-equity investors, according to the agency. Even larger mega partnerships have formed in recent months, such as the $100 billion Global AI Infrastructure Investment Partnership involving Blackrock, Microsoft and MGX, as well as KKR and Energy Capital Partners’ $50 billion partnership to invest in data centres and power generation over a number of years. After this recent surge in investment activity, Moody’s expects the pace of M&A will remain high in emerging markets but is likely to moderate in established markets.

Corporate real estate investment trusts (REITs), commercial real estate developers, telecommunication companies and private equity hyperscale data centre developers continue to incur new debt to expand hyperscale data centre capacity. Most of this new capacity is typically pre–leased to high-rated hyperscaler tenants, mitigating the risk of surplus capacity entering the market without tenants.

But as eager developers court hyperscalers in hopes of serving their long-term data centre needs, their financial risk exposure may rise as they offer increasingly favourable tenant lease terms, including shorter initial lease terms with shorter extension options at the tenant’s will. Asia-Pacific (APAC) telecommunication companies are partnering with peers or data centre operators to mitigate investment risk and protect their balance sheets.

Component costs are tight

Data centre suppliers of things like medium and low voltage power distribution products; backup and uninterruptible power systems; heating, ventilation, air conditioning (HVAC) and cooling systems; security systems; and building automation systems will benefit from the growing demand.

Companies within the data centre value chain are either adjusting their operations or investing in new production capacity and products to meet high demand. Until additional capacity can be integrated into the supply chain, this heightened demand will drive up costs for key components, including mechanical cooling systems and electrical equipment for data centres, as well as internal components such as semiconductors and computing equipment. Developers and landlords are passing on these increased costs to tenants through higher lease prices, which continue to rise as vacancy rates remain at historically low levels in most markets.

Lead times stretch

Moody’s also warns that developers and contractors have adjusted their schedules to accommodate longer lead times for essential electrical equipment, such as transformers and backup generators. They also try to account for the time required to secure new grid connections for the new substations, yet these timelines can be extended unexpectedly if utilities halt new connections to manage grid reliability.

This extended time to market has led to greater diversification among developers and hyperscalers, who are increasingly focused on identifying or developing locations with reliable and sustainable power and water supply, as well as fast connectivity. Furthermore, the global demand for electricians, electrical engineers and HVAC technicians exceeds supply, creating a constraint on both initial construction and long-term operations.

Moody’s reckons around $2.5 trillion of investment needed to meet unconstrained demand growth through 2028.

Private equity to plug the gap

Private capital will continue to pour into data centre development, which will help to meet hyperscaler demand for more and larger data centres. Medium-size and large data centre REITs and developers have been eagerly snapped up by major private-equity investors. The largest global data centre REITs have also announced partnerships with significant private credit investors and even larger mega partnerships have formed in recent months. Meanwhile, privately owned data centre developers like Vantage Data Centres will continue to benefit from substantial multibillion-dollar equity investments from prominent private digital infrastructure investors.

After this recent surge in investment activity, Moody’s said the pace of M&A transactions will remain high in emerging markets but is likely to moderate in established markets. The formation of large investor partnerships will also likely to proceed at a more measured pace until the initial capital commitments are deployed. Nevertheless, significantly larger investments will still be required, with new mega partnership investments likely to continue in the coming years.

Public backlash

According to Moody’s public concerns about data centres’ urgent need for massive amounts of electricity will increasingly come to the fore, particularly in established US and European markets. Some state and regional governments continue to offer tax incentives to attract new data centres, which increases the concentration of data centres in their jurisdictions and potentially exposes utilities to heightened social risk as rising demand and higher capital costs increase power prices for customers. At the same time, the industry is already coming under greater political and regulatory scrutiny in other jurisdictions.

Utilities and regulators in all markets are increasingly focused on how the immense electricity requirements of data centres will affect other ratepayers and utilities’ long-term power supply resource planning to maintain reliability amid rising exposure to physical climate risks. This focus on affordability and reliability is already influencing the US ratemaking process, according to Moody’s. For example, American Electric Power Company subsidiary Ohio Power Company has requested approval from the Public Utilities Commission of Ohio (PUCO) for a settlement agreement that requires new large data centre customers to pay for at least 85% of their monthly energy needs, regardless of actual usage.

The objective is to ensure adequate cost recovery for the utility, while protecting other retail customers from bearing the expenses of infrastructure investments that might become unnecessary if data centre demand does not meet projected levels. If approved, the settlement may serve as a model for similar agreements in other regions. Moody’s also warns that to cope with surging demand utilities are considering building new natural gas-fired generation and delaying previously announced retirement plans for existing fossil-fuel plants. In a limited number of cases, developers are even signing power purchase agreements with coal plants to ensure reliability.

Moody’s highlights Spain, where in response to rapid growth in data centre power demand, the country is likely to roll out new regulations over the next year or two that seek to balance the need for utilities to provide reliable and affordable electricity as they navigate their transition to renewable power, while protecting ratepayers from the risk of unused generation capacity if data centre demand falls short of projections.

Despite growing public pushback, Moody’s concludes that large data centres will continue to proliferate in established markets and spread to new markets. The training of larger AI models at AI data centres can occur anywhere in the world, but the deployment of AI services today is still most effectively done from data centres in established markets located near major population centres. At the same time, improvements in connectivity continue to diminish the need to locate cloud computing data centres close to highly populated areas.

[Author: Simon Dux]

[1] The source material – you may be asked to register to access this: https://info.moodys.com/OTYxLUtDSi0zMDgAAAGYBnP9JhCRLasDBgykW9n3ZNLBfIBOQGG8dcguzNtJ9njVYGCogBRfHWq3VrodSJISZxO4Ykc=