Malaysia is projected to see a sevenfold rise in data centers’ power consumption, from just 8.5 TWh in 2024 to 68 TWh in 2030 which will make up about 30 per cent of the country’s total power demand in 2030, Ember, an energy think tank revealed recently.

“This is equivalent to adding Singapore’s entire power consumption in 2023 of 57 TWh,” it added.

Coming in second is Indonesia which is projected to quadruple its data centers’ power consumption, rising from 6.7 TWh in 2024 to 26 TWh by 2030. The Philippines is projected to see its electricity demand from data centers rise even more steeply, at almost 20 times at 1.1 TWh in 2024 to 20 TWh in 2030.

Singapore and Thailand’s power demand from data center is projected to see a less dramatic rise, increasing slightly from 5 to 8.4 TWh and from 2.4 to 6 TWh, respectively, while Vietnam is likely to see minimal rise, from 0.7 TWh in 2024 to 1.2 TWh in 2030.

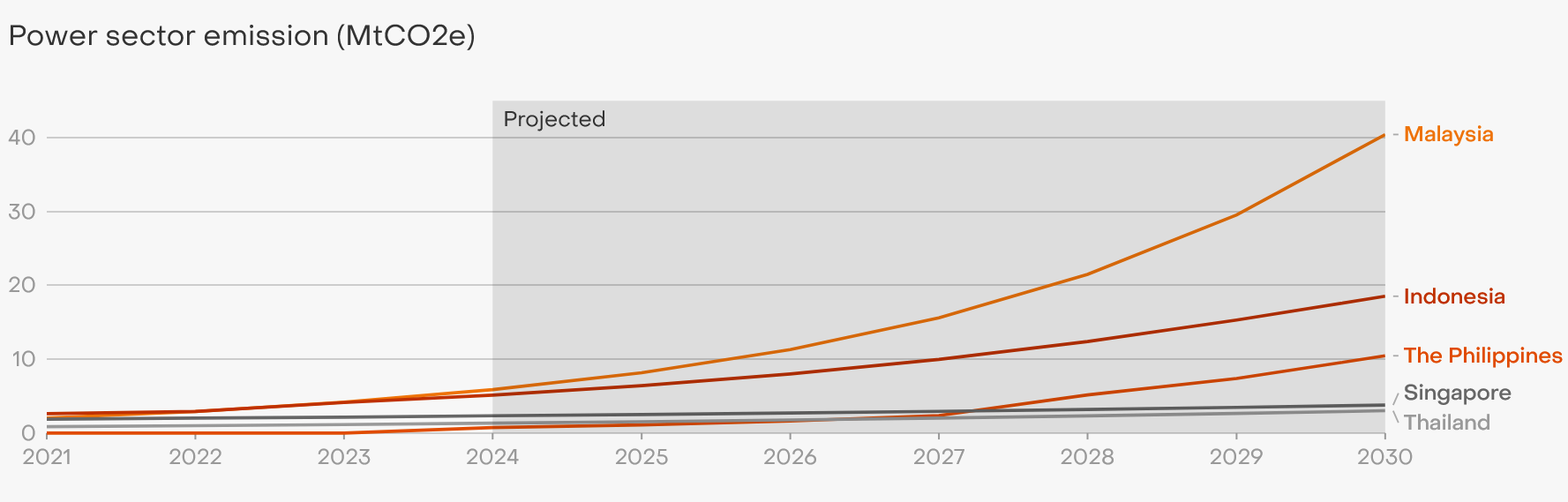

Along with higher power consumption, ASEAN data centre emissions will also keep rising in tandem, led by Malaysia, the Philippines and Indonesia, due to fossil-dependent grids, the think tank projected.

In Malaysia, emissions from power consumption alone (excluding emissions from construction, transportation and other activities) will likely increase seven-fold from 2024 to 2030, driven by the country’s rapid data centre growth which still relies heavily on coal and gas as power sources.

Similarly, Indonesia which also depends heavily on coal and gas power, will likely see grid emissions rise from 5 MtCO2e in 2024 to 19 MtCO2e by 2030 particularly along the Java-Madura-Bali (JAMALI) grid where most data centers are concentrated.

In the Philippines, emissions is projected to surge 14 times from 0.8 MtCO2e in 2024 to 10.5 MtCO2e by 2030 driven by the Luzon-Visayas grid’s heavy reliance on coal. The think tank added however that while the national power grids in the Philippines are interconnected, universal emission factors are not yet publicly available.

As expected, emissions from data centre power consumption in Singapore and Thailand remain relatively stable. “Singapore’s emissions see minimal growth between 2024 and 2030, rising by just 1.5 MtCO2e, while Thailand experiences a modest increase, doubling its 2024 level by 2030.”

Source: Ember’s analysis based on publicly available ASEAN data center capacity projections and grid emission factors data from the governments. The Philippines’ data is only available from 2024.

To meet the projected surge in data centre power demand and counter the surge in emissions, the region’s top five data centre-consuming countries must scale up solar and wind energy investment, Ember suggested. It projected that an estimated US$ 45 to US$ 75 billion investments in solar and wind capacity would be needed by 2030 to power data centres sustainably and avoid dependence on fossil fuels.

To remain competitive, data centers need reliable and clean electricity – sourced from renewables but due to limited options and the early stage of corporate renewables procurement mechanisms in some ASEAN countries, most data centres still rely on fossil fuel-reliant grids, hampering efforts to reduce emissions from power consumption.

According to Ember’s report, if renewables growth does not keep pace with demand, it would result in higher emissions, long-term risks, including fossil fuel price volatility, geopolitical disruptions, trade restrictions, stranded fossil fuel assets, rising costs of fossil fuels and non-compliance with international carbon tariffs.

Further, if left unaddressed, the digital infrastructure ambitions of these six countries could strain electricity availability for other sectors, Ember said, emphasizing the urgent need for stronger policy support to accelerate decarbonisation.