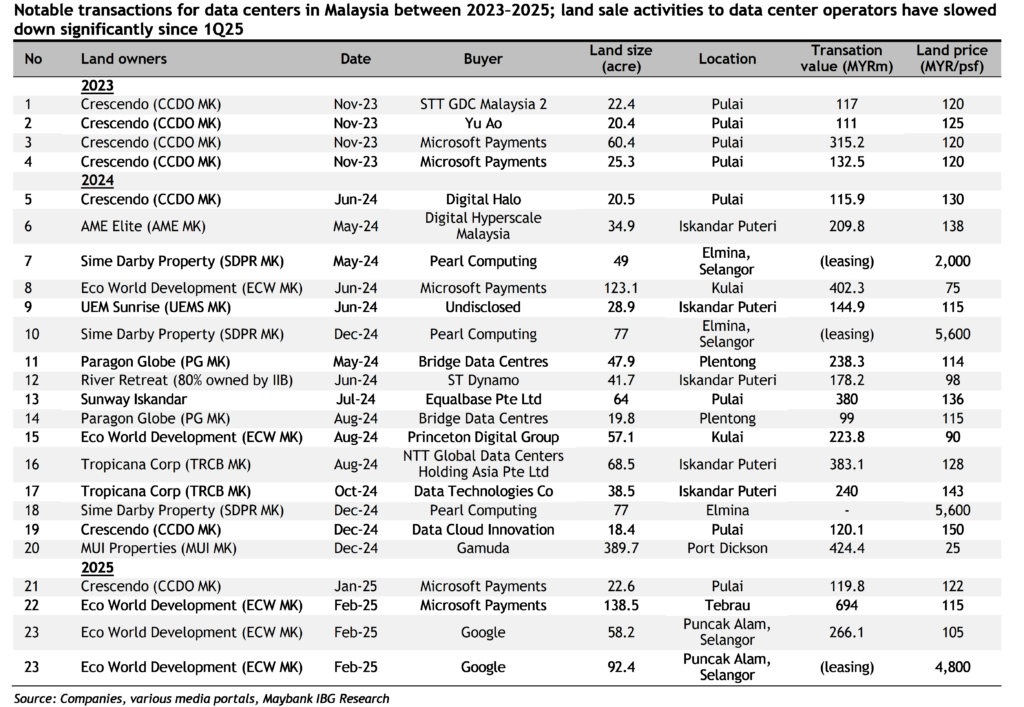

Land sale activities in Malaysia to data center operators have slowed down significantly since 1Q2025, according to Maybank IBG Research’s latest note when giving the 2025 review.

“The Malaysian data center sentiment weakened early in 2025 following the US government’s tightening of AI chip export restrictions, which had an immediate knock-on effect on data center investment activity in the region. As hyperscalers reassessed expansion timelines and capital deployment amid greater regulatory uncertainty, land purchases for data centre developments slowed, particularly for large-scale industrial plots. This weighed on industrial land sales momentum, which had been a key earnings and sentiment driver for selected developers since 2023.”

It added: “S.P. Setia Berhad was supposed to sign a joint venture agreement with a foreign party to jointly develop its 307-acre Tanjung Kupang land in Iskandar Puteri into an industrial park with high-tech manufacturing and data centers in January 2025; however, the deal was called off a week before signing after tighter regulations on AI chips were introduced. Elsewhere, Mah Sing Group’s JV development of data center facilities and infrastructure (53 acres) with Bridge Data Centres at Southville City, Bangi, lapsed in May 2025 and Oct 2025, according to The Malaysian Reserve.”

The external backdrop became more challenging ahead of mid-2025 as renewed tariff rhetoric and policy actions under Trump, prior to Aug 2025, further clouded the global trade and growth outlook. This heightened uncertainty weighed on business confidence and tempered appetite for big-ticket purchases and expansion plans. This has led to higher logistics and transportation costs across the construction and property value chain, further pressuring margins and elongating project timelines.

As a result, the research house sees the risk of higher costs and execution risks continuing into 2026.