India’s data center market could see capacity across the top seven cities exceed 4,500MW or 4.5GW by 2030, which in turn is likely to translate into real estate footprint of around 55 million sq ft in the next 5-6 years, says a new report by Colliers. It further says that this is likely to attract investments to the tune of US$ 20-25 billion.

According to the report titled The digital backbone: Data center growth prospects in India the country’s data center capacity stood at 1,263MW as of April 2025, and that that the rapid capacity expansion has resulted in a real estate footprint of about 16 million sq ft across top seven data center markets of the country. In a press release Colliers said, “This growth is driven by the surge in demand for digital & cloud services, increasing adoption of Artificial Intelligence (AI) & Internet of Things (IoT), and higher internet penetration, supported by favorable government policies. ”It further said, “The industry has already seen investments to the tune of USD 14.7 billion since the beginning of 2020. These investments have been largely focused on land acquisition, project construction & development etc. In the next 5-6 years, amidst massive adoption of cloud computation and AI in India, DCs are likely to attract investments to the tune of US$ 20-25 billion.”

Mumbai still at the top, emerging markets growing stronger

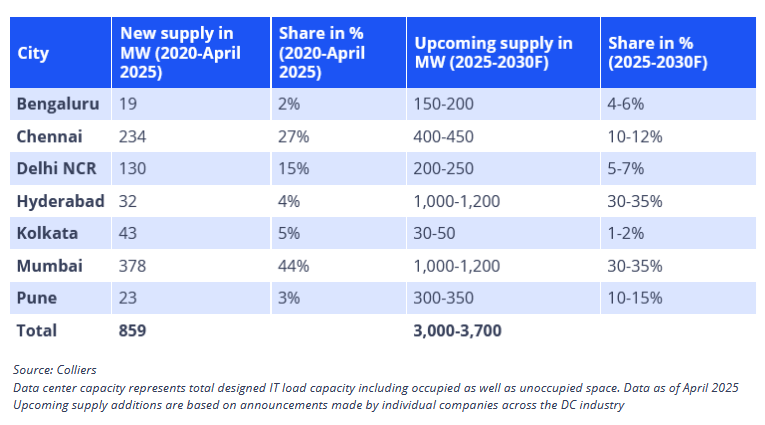

The report further revealed that Mumbai has held on its pole position as the largest data center market in India. “At the city level, Mumbai continued to account for majority of the DC capacity with 41 percent share, followed by Chennai & Delhi NCR at 23 percent & 14 percent respectively,” Colliers said. In fact, Mumbai drove 44 percent of data center capacity additions since 2020. This was followed by Chennai and Delhi NCR which together accounted for 42 percent of the capacity addition since 2020.

The report predicts that Tier 1 markets are likely to witness This was followed by Chennai and Delhi NCR which together accounted for 42 percent of the capacity addition since 2020, which is four times compared to the new supply during 2020-2025. “While Mumbai will continue to dominate the overall DC market, relatively smaller growth markets such as Hyderabad, Bengaluru and Pune are likely to see multifold growth in inventory levels. Hyderabad, specifically, is likely to see significant traction and emerge as a major hub, in addition to cities such as Mumbai, Chennai & Delhi NCR,” said the report.

There will also be a huge emphasis on building data centers that are ready for AI and HPC workloads, as well as greater commitment towards sustainability.

“Operators & developers will increasingly seek land-banking strategies and expand into growing markets with high data consumption levels. Moreover, investments in energy efficient and green certified DCs too will gain larger ground, as leading players increasingly imbibe sustainable practices. Green penetration in the industry, thus is likely to increase from 25 percent currently, to 30-40 percent by 2030,” says Vimal Nadar, National Director & Head Research, Colliers India.

Hyperscalers will lead growth, but Edge has found its footing

The report also found that there was growing interest in hyperscale data centers. “The rise in proportion of larger-sized DCs (>20 MW) from 42 percent during 2020 to 56 percent as of April 2025, indicates heightened traction in large hyperscale data centers, especially in recent years,” said and went on to reveal an interesting trend vis-à-vis data centers with capacities between 21-50MW. “Within the 21-50 MW category, Mumbai drove about three-fourths of the new supply additions. Interestingly, Chennai accounted for 45 percent of the new completions during the period in the >50 MW category. Going ahead we estimate, DCs exceeding 50 MW capacity are likely to account for nearly two-thirds of the inventory by 2030,” it said.

However, the sun shines bright on Edge data centers that will also thrive across India.

“Undoubtedly, India’s strategic advantages such as availability of land parcels, power supply for usage and availability of skilled talent, reinforces its position as one of the preferred destinations for data centers in the APAC region,” said Jatin Shah, COO, Colliers India. “Interestingly, the market is expanding beyond large-scale colocation facilities and hyperscalers to edge data centers driven by increasing need for lower latency, real-time analysis, enhanced app performance, and business agility.”