Following a spate of announcements last week on financing deals for data centers in Asia, more potential deals are underway. A Singapore operating entity of Australia’s Firmus Technologies is seeking a US$ 120 million private loan to fund its capital expenditure, while India’s Yotta Data Services Pvt. is in talks with private credit funds to raise about US$ 500 million for its data center parks, according to Bloomberg. Last week saw record financings obtained by Bridge Data Centres (US$ 2.8 billion) for its operations in Malaysia, while DayOne launched a US$ 3.4 billion-equivalent borrowing into market.

Newcomer CURRENC Group Inc., a fintech pioneer also recently announced plans to acquire 100 acres of land in Johor, Malaysia, to build a 500MW hyperscale Artificial Intelligence Data Center (AIDC) to be financed by a planned AI Fund in collaboration with ARC Group, a leading global investment bank.

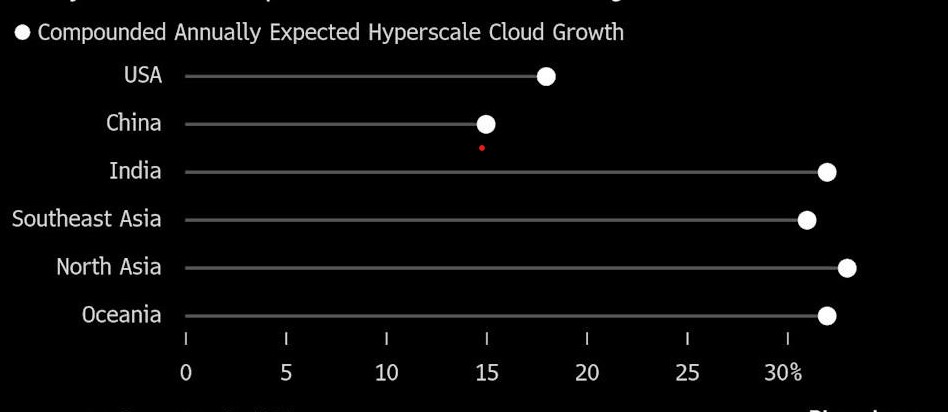

The trend to tap into funding sources beyond banks is not letting up as more such potential financial deals are being negotiated. Demand is set to expand by about 32% a year through 2028, according to data by real estate services firm Cushman and Wakefield, outpacing the US’s expected growth of 18%.

But the US tariff policy could be a wild card for the industry, said Bloomberg, quoting Yemi Tepe, a partner at law firm Morrison Foerster, which has worked on such deals.

“Banks have historically been the main source of funding for large scale projects, but the emergence of private credit and infrastructure funds have expanded financing avenues,” said Tepe.

The lawyer warned however that geopolitical risks could potentially undermine the funding frenzy. With more tariffs expected from the US, a wider trade war involving countries that supply the data center industry — largely in Asia — as well as some of the key components it relies on, like semiconductors could emerge. Projects could also face holdups if supply chains are disrupted. “This could result in investors demanding higher risk premiums or choosing to divest from projects tied to Chinese entities,” added Tepe.