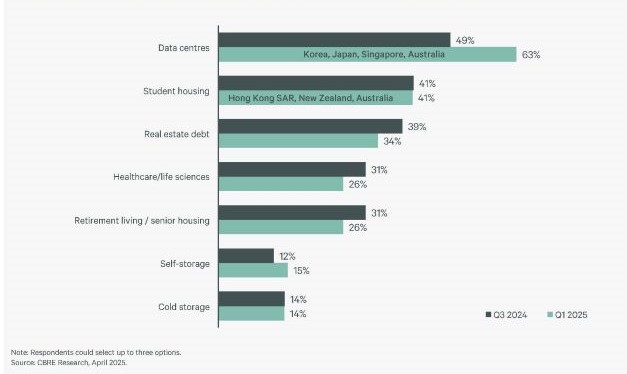

Data centers surged ahead as the clear favourite among alternative assets favoured by investors capturing 63% of total votes in Q1 2025 compared to 49% in Q4 2024, and ahead of student housing which trailed at 41%, according to CBRE’s Q1 2025 Asia Pacific Cap Rate Survey report launched today. The bi-annual survey among CBRE’s brokers and valuers was conducted in April following the U.S.’s announcement of wide-ranging import tariffs.

“Investor sentiment remains stable, with half of the respondents reporting no change in risk appetite,” said Ada Choi, Head of Research, Asia Pacific, for CBRE. Moreover, “CBRE had forecasted a 5% year-over-year increase in investment volume in 2025, driven by interest in sectors with strong fundamentals and structural growth, particularly Australian retail properties, along with multifamily and data centre assets,” Choi added.

“While investors have paused to take stock after the introduction of tariffs, particularly those assets directly exposed to exports, the impact has been largely confined to export-related sectors. Overall, the broader Asia Pacific real estate market remains resilient. With greater clarity starting to emerge, investor interest continues to deepen in Asia Pacific real estate across multiple markets and asset classes,” said Greg Hyland, Head of Capital Markets, Asia Pacific, for CBRE.

Data centers are a clear favourite in Q1 2025. Source: CBRE