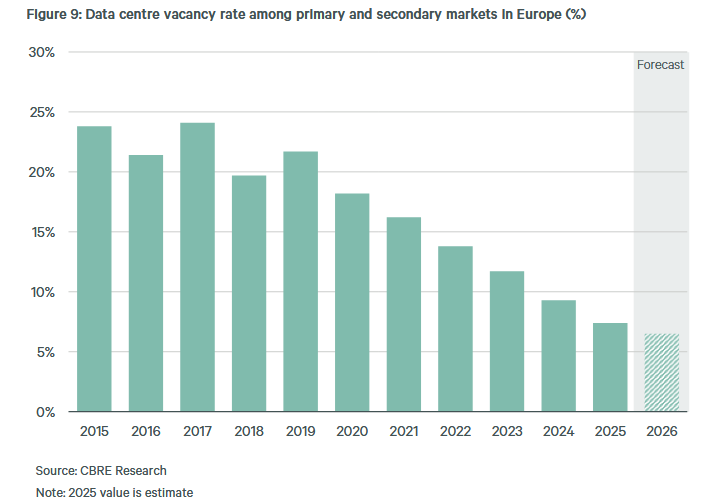

Rapid growth in artificial intelligence is intensifying pressure on Europe’s data center sector, compounding existing strains from wider digitalisation and limited power infrastructure. Vacancy rates across European data centers are expected to fall to record lows over the next two years as new capacity comes online at an unprecedented pace.

According to CBRE’s European Real Estate Market Outlook 2026 vacancy dropped below 10 percent in late 2024 and is forecast to decline to 6.5 percent by the end of 2026. Over 750 MW of data center capacity is expected to be added across Europe in 2026 this is equivalent to the entire colocation capacity of France. The supply majority is already absorbed through pre-let agreements, limiting relief for customers seeking near-term space.

Modern data center trends

European data center operators are adopting on-site power generation as grid capacity constraints and delayed connection timelines hinder expansion plans. This has been incorporated as a longer-term strategy. Industry participants expect on-site power generation to increase as tenants become more comfortable with alternative power solutions.

Companies are forced to seek new sites and consider multiple submarkets or cross-border options to secure suitable space. Assets capable of delivering near-term capacity are commanding premium pricing, and further increases are anticipated as demand continues to outpace supply.

Established hyperscale providers remain active, newer entrants such as GPU-as-a-Service operators, are now competing for double-digit megawatt capacity across European markets. This is expected to broaden the wholesale tenant base and alternate demand.

Despite strong demand, most developers remain reluctant to pursue fully speculative data center projects due to the substantial capital investment required. Instead, partial pre-leasing has become standard practice. With emerging companies expected to drive more short-notice capacity requirements, industry observers warn that the supply-demand imbalance could intensify through 2026.

AI training and inference workloads are reshaping the sector with rising power density requirements. Operators are investing in high-density infrastructure upgrades to accommodate these demands, while focus on traditional and lower-density facilities continues to shape the fragmented technology landscape across Europe’s data center market.