Despite its intermittent nature, solar power will remain a key source of sustainable energy for the data center industry, finds a recent report by global real estate advisory and research firm JLL. The pivot to renewable energy will be driven by the rising cost of electricity, and tightening carbon compliance requirements.

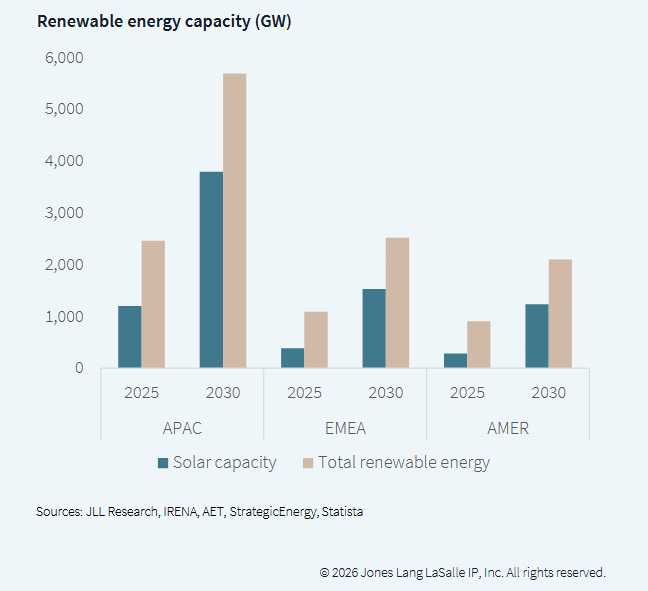

“Renewables are expected to outcompete fossil fuels on cost across all major regions,” says the report titled 2026 Global Data Center Outlook, adding, “Global renewable capacity is projected to exceed 10,000 GW by 2030, with solar representing 64 percent of that total.”

Acknowledging the mind-boggling cost of electricity, the report says, “Data centers worldwide are facing mounting pressure from the rising cost of grid electricity, often exceeding $100 per MWh, and tightening carbon compliance requirements. This economic and regulatory squeeze will accelerate the pivot toward renewables as the primary energy source for hyperscale and colocation facilities.”

It acknowledges that other renewable energy sources will also play a significant role, but maintains that solar energy will be the overwhelming favourite. “Onshore wind will likely stabilize at $25 to $40 per MWh, while offshore wind remains competitive at $60 to $80 per MWh,” says the report. “Solar will account for nearly half of global renewable energy capacity in 2026, and despite its intermittent properties, solar will remain a key source of sustainable energy for the data center sector for years to come.”

However, the report recommends that solar procurement models need to “evolve to counter near-term price volatility caused by new supply-side policies.” But goes on to say, “Despite this pressure, the levelized cost of energy (LCOE) for solar is projected to fall below $30 per MWh by 2035 due to declining balance-of-system costs and ongoing efficiency gains.”

The report goes on to say, “As a result of the attractive cost profile and sustainability benefits, solar-plus-storage will become a key component of global data center energy strategies by 2030. While some of this energy harvesting will be colocated with data center facilities, much of the energy infrastructure will be installed off-site.”

Shedding light on solar adoption trends it finds that it will have the most takers in APAC with China dominating the landscape. “Solar capacity is projected to expand to nearly 4,000 GW by 2030, with China accounting for approximately 80 percent of this growth,” it says, while also cautioning operators about “near-term price volatility originating from China’s industrial policy.”

It goes on to predict, “Solar capacity in EMEA and AMER is projected to grow steadily through 2030 but on a smaller scale,” and that, “Supply additions in each of these regions will likely represent 50 percent of APAC’s volume.”