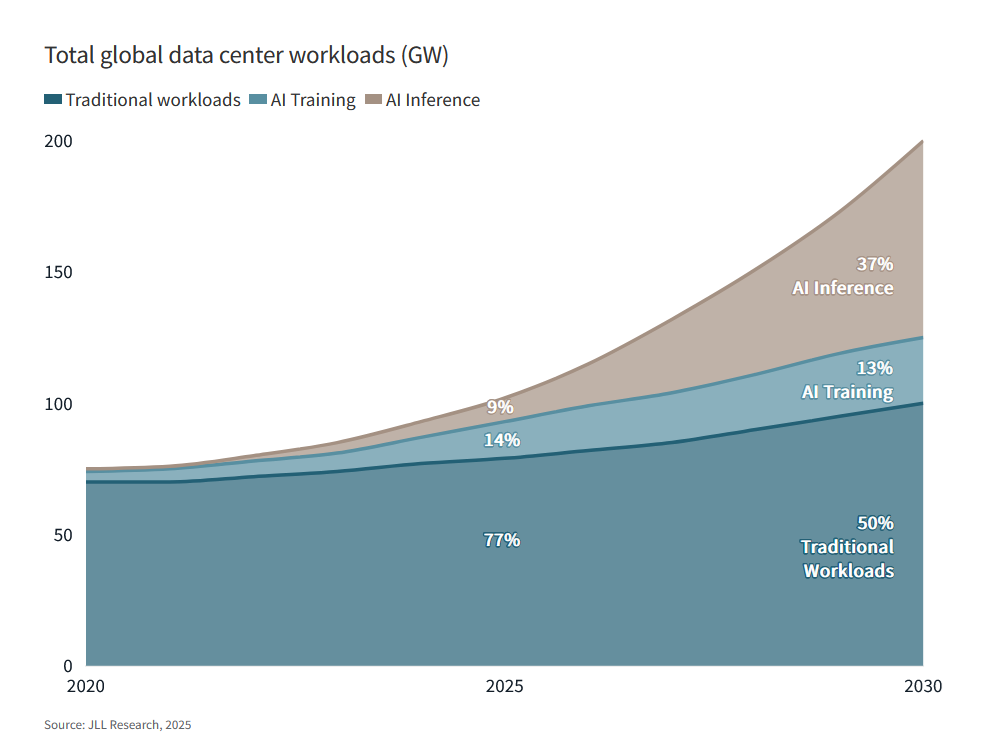

According to a recent report by JLL, data center capacity across the world could go up by 100 GW by 2030. It also finds that by then, AI could represent half of all workloads with inference becoming the primary driver. Moreover, this explosive growth will require investments worth a mind-boggling US$ 3 trillion over the next five years.

The report titled 2026 Global Data Center Outlook says, “Roughly 100 GW of new capacity is anticipated to come online between 2026 and 2030, equating to $1.2 trillion in real estate asset value creation.” It further says, “The global data center sector will likely expand at a 14 percent CAGR through 2030, which will require energy innovations to alleviate grid constraints. Hyperscalers will remain a key driver of sector growth, executing a dual strategy of leasing and self-building.”

“We’re witnessing the most significant transformation in data center infrastructure since the original cloud migration,” says Matt Landek, Global Division President, Data Centers and Critical Environments at JLL. “The sheer scale of demand is extraordinary. Hyperscalers are allocating $1 trillion for data center spend between 2024 and 2026 alone, while supply constraints and four-year grid connection delays are creating a perfect storm that’s fundamentally reshaping how we approach development, energy sourcing and market strategy.”

JLL anticipates a critical inflection point in 2027 when AI inference workloads will overtake training as the dominant requirement.

“We’re witnessing the emergence of an entirely new infrastructure paradigm where AI training facilities demand 10x the power density and command 60 percent lease rate premiums over traditional data centers,” says Andrew Batson, Global Head of Data Center Research at JLL. “Beyond the economics, AI has become a matter of national strategic importance, driving countries to develop domestic capabilities through sovereign infrastructure investments that represent an $8 billion CapEx opportunity by 2030.”

JLL projects that AI chips could grow their total revenue share from 20 percent to 50 percent of the semiconductor market by 2030, with custom silicon expected to capture 15 percent market share as hyperscalers develop their own processors. The future could include emerging technologies like neuromorphic computing for ultra-efficient inference tasks that could reduce infrastructure demands and enable data centers to be more power-efficient.

However, the report also points out, “Supply chain and construction delays will continue to affect timelines. Over half of projects faced delays in 2025; tenants can no longer assume delivery dates without buffers.”

JLL also finds that energy sourcing remains a “critical challenge”, and that due to utility interconnection delays, and mounting pressure from rising grid electricity costs, some operators are moving to directly fund their own energy generation.

Finally, when it comes to securing funding for ambitious global digital infrastructure projects, JLL finds, “The sector is experiencing significant capital markets maturation, with core investment strategies now representing 24 percent of fundraising activity, up from less than 10 percent previously. More than US$ 300 billion in global M&A activity has occurred since 2020, though future investment is expected to shift toward recapitalizations and joint ventures as the market matures.” It further predicts that global data center core fund capital formation could top US $50 billion in 2026, with strategies targeting returns of 10 percent or more.